Purveyors of Scale®

Specialists in scaling companies with technology at our core.

Whitewater.

We are a specialist advisory firm for companies seeking to leverage compounding growth systems with technology at our core.

Our expertise lies in implementing strategies, systems, solutions, and structures that supercharge our clients' competitive edge in an increasingly interconnected digital world.

We ❤ connecting the dots.

Our Services

We develop comprehensive growth strategies that align with your values and business objectives, leveraging market insights and data-driven rigour to create actionable execution roadmaps. Roadmaps that either grow your topline or reduce your costs — preferably both.

Our systems approach integrates technology, processes, and people to create efficient, scalable operations that drive business growth and operational excellence. Our holistic model is to distill complex environments into modular, maintainable, and scalable systems.

We've built across a range of industries and needs, from sub-millisecond capital markets to intergenerational forestry assets. Anything from PID-controllers with Kalman-filters for rocket engines to Kolmogorov-Arnold networks for thermochemical kinetics discovery models. And everything in between.

We design and implement corporate structures that optimize outcomes, foster innovation, and support sustainable growth in a changing business landscape; Off-Balance Sheet, SPVs, Ephemeral entities, Protected Cell Companies, and much more.

Core Industries

We specialize in high-frequency trading systems, market making algorithms, and risk management solutions for global capital markets. Our expertise spans across equities, fixed income, derivatives, and crypto markets.

From retail banking to investment management, we deliver innovative solutions that enhance customer experience, streamline operations, and ensure regulatory compliance in the financial services sector.

Energy and waste management are vital for thriving societies. We help our clients manage their energy and waste opportunities in a sustainable way, from designing new breakthrough technologies and their management to implementing carbon accounting models and trading solutions.

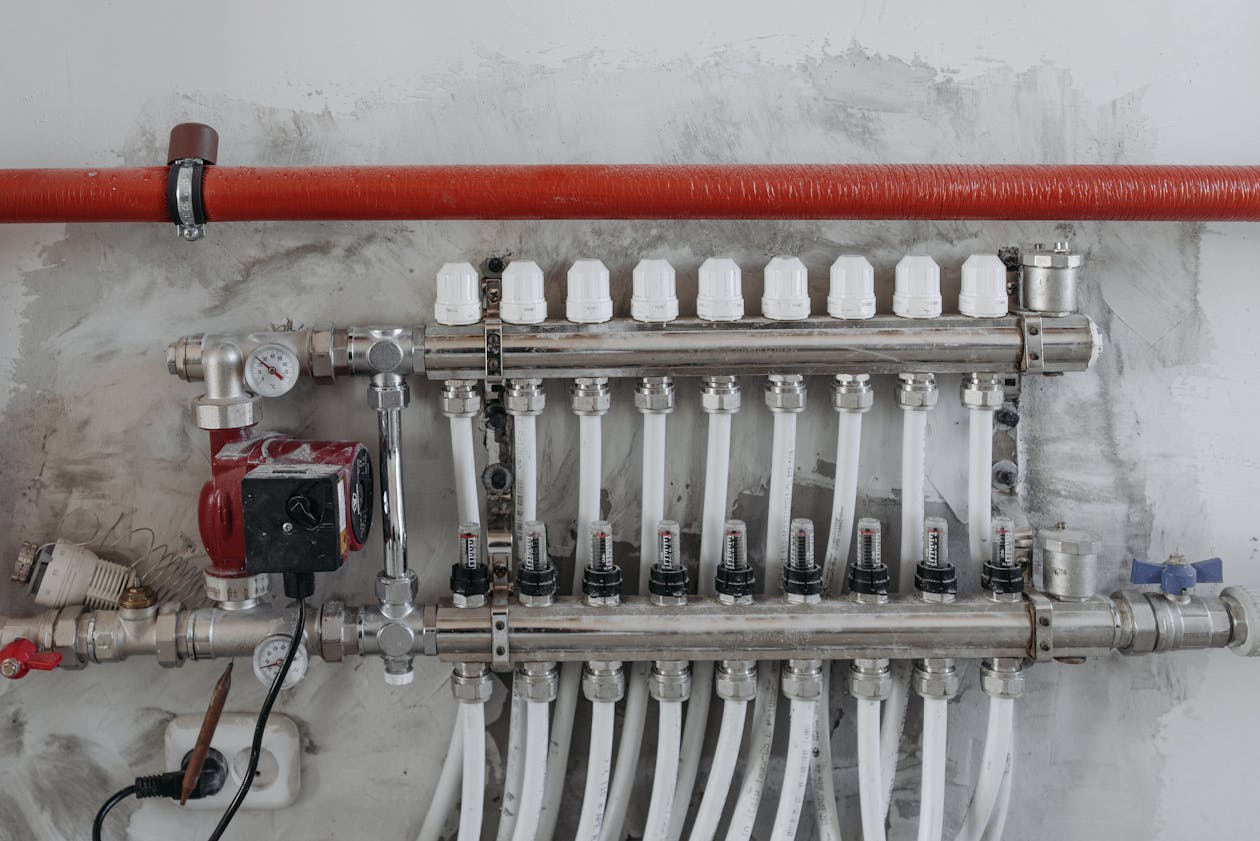

We bridge the gap between industrial operations and digital transformation, implementing IoT solutions that optimize manufacturing processes, predictive maintenance, and supply chain visibility. From adding a sensor to building a fully integrated SCADA system, we're happy to help.

Our insurance solutions range from claims processing automation to risk assessment models, helping insurers modernize their operations and enhance underwriting accuracy.

We optimize logistics operations through advanced route planning, real-time tracking, and inventory management systems that reduce costs and improve delivery efficiency.

Case Studies

Full case studies available on request.

Refinery Waste — Feasibility Study

Middle East - Oil & Gas

We supported a regional refinery in evaluating the feasibility of converting downstream process waste into high-value by-products. Our team modelled thermal and catalytic conversion scenarios, mapped potential revenue streams, and assessed regulatory implications. The preferred pathway reduced hazardous output by 34% and projected payback within 24 months under standard operating conditions.

Trade Finance — Receivables Securitisation

Europe - Financial Technology

We partnered with a European FinTech to design a novel financial instrument by securitising cashflows from trade receivables. Our team developed a risk-scoring algorithm incorporating counterparty analytics, market dynamics, and historical performance data. The resulting asset structure enabled SMEs to access working capital at competitive rates while providing institutional investors with a new fixed-income product.

Water Distribution — Discovery Program

Indian Ocean Territory - Water Distribution

In collaboration with a regional water utility provider, we conducted a discovery program to map interdependencies between pump activation cycles, sensor lag, and pressure regulation inconsistencies. Our team implemented an augmentable variable model, introducing virtual sensors and algorithmic process controls. Within four months, the error rate in flow-pressure anomalies reduced by 63%, and reactive maintenance costs dropped by 41%, yielding a net-positive ROI in less than 6 months from deployment.

Thermochemical Kinetics — Digital Twin

Europe - Renewable Fuels

We partnered with an industrial R&D facility to develop a digital twin of their thermochemical conversion process. By integrating real-time sensor data with a kinetics-driven simulation engine, we enabled dynamic tracking of reaction pathways and heat profiles. Within three months, the neural network model achieved 99.8% accuracy in predicting reaction rates and heat profiles, reducing experimental costs by over 75%.

Venture Capital — Dealflow Automation

Europe - Financial Services

We worked with a growth-stage venture capital firm to streamline and scale their dealflow pipeline. By deploying an AI-assisted screening layer integrated with CRM and portfolio analytics, we automated first-pass filtering and prioritization. Deal review cycle time dropped by 52%, while high-fit lead identification improved by 38% within the first quarter.

Capital Markets — Latency Optimization

United Kingdom - Prop Trading

We helped a UK-based prop trading firm achieve millisecond-level reaction times to high-frequency news feeds by implementing L1 cache–optimized Bloom filters, bypassing tokenisation needs for sentiment analysis. This reduced signal processing latency by an order of magnitude, giving the firm a measurable edge in ultra-low-latency environments.

Energy Trading — Risk Engine

Europe - Energy Trading

We collaborated with a regional energy trading company to develop a risk management system that integrates real-time market data with advanced analytics. By deploying a multi-factor model, we enabled dynamic risk assessment and portfolio optimization, reducing exposure to market fluctuations and improving return on investment.

Forestry Assets — Carbon Sequestration

Europe - Nature-backed Assets

We designed a system for the tokenisation of biomass growth, leveraging aerial LiDAR to assess carbon sequestration across forestry assets. By integrating geospatial analytics with verifiable on-chain data, we enabled real-time valuation of carbon yield, supporting both ESG reporting and voluntary carbon market participation.

Hedge Fund — Trading Signals

Europe - Asset Management

We developed a sophisticated trading signal system for a European hedge fund using LSTM and KAN neural networks. By processing multiple data streams including market sentiment, technical indicators, and alternative data sources, we created robust predictive models for volatile asset trading. The implementation resulted in a 6%-pts improvement in risk-adjusted returns during high volatility periods and enhanced position sizing accuracy by 19%.

Whitewater Partners

London

35-37 Ludgate Hill, Office 7

London, EC4M 7JN

United Kingdom

Abu Dhabi

24th Floor, Al Sila Tower

Abu Dhabi, ADGM

United Arab Emirates

Let's Collaborate

We're always open to discussing challenging opportunities and innovative projects. As long as you're not breaking the laws of physics, ethics or economics — we're ready to help.

Reach out to us to start a conversation about how we can work together to deliver scale.